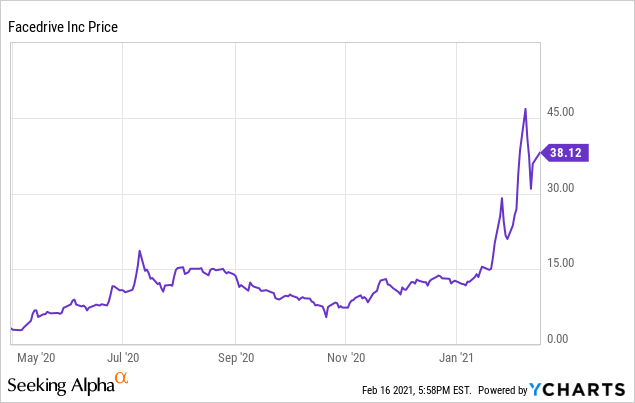

Facedrive (FDVRF) is an unabashed promotional stock that has jumped 10x over the past twelve months, including a 3x so far in 2021 to a market cap of $3.8B (CAD 4.8B for the underlying FD.V shares). While I have written about other heavily-marketed, extremely-overvalued companies with dreadful operations over the past ten years, Facedrive takes the cake.

Data by

Data byAs a background, Facedrive was founded in 2016, but only started operating its local ride sharing service in Q4 2018 with $14k in revenues. In August 2019, Facedrive completed an RTO (reverse take-over) with High Mountain Resources and listed on the TSX Venture Exchange.

Facedrive’s main investment is in widespread investor marketing of unsuccessful, money-losing initiatives that have generated $774k (CAD 983k) in revenues over the last twelve months at a net loss of $12.5M (CAD 15.9M). At the current price of $38.12 (CAD 48.01), Facedrive’s enterprise value/revenues ratio is an astounding 4,728x.

Perception versus Reality

The bulk of the company’s SG&A expense was a 2020 Q2 $6.5M (CAD 8.2M) initial share-in-kind payment, followed by seven monthly payments of an undisclosed amount, to Medtronic Online Solutions, Ltd – a BVI company. Leacap Ltd changed its name to Medtronic Online Solutions just before the Facedrive transaction in March 2020. Medtronic BVI is tied to oilprice.com (Medtronic Online Solutions, p.k.a. Leacap Ltd, trading as safehaven.com, is the contributor to oilprice.com). Oilprice.com is a website that provided several promotional Facedrive articles (per the first ten Google search results using "oilprice.com - facedrive releases").

Source: Hindenburg Research

In the Disclaimers section at the bottom of these articles (see this recent article for example), Oilprice.com admits that "This share position in FD.V is a major conflict with our ability to be unbiased... The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market" (a potential pump-and-dump scenario, where potential retail investors, who normally don't read Disclaimers at the very bottom of articles, could be buying high-priced shares as the author of the promotional article is selling).

While other companies of a similar ilk use YouTubers to spread their stories without a direct promotional link, Facedrive starts off the video by stating that “this video is sponsored by Facedrive”.

For the Fiscal Period Ending 3 months Q4 Dec-31-2019 3 months Q1 Mar-31-2020 3 months Q2 Jun-30-2020 3 months Q3 Sep-30-2020 Currency CAD CAD CAD CAD Total Revenue 0.235 0.388 0.094 0.266 Cost Of Goods Sold 0.083 0.248 0.125 0.143 Gross Profit 0.152 0.139 (0.032) 0.123 Selling General & Admin Exp. 1.469 1.515 9.047 2.866 R & D Exp. 0.182 0.233 0.291 0.491 Depreciation & Amort. 0.017 0.017 0.017 0.180 Amort. of Goodwill and Intangibles - - 0.104 0.172 Other Operating Exp., Total 1.668 1.764 9.458 3.708 Operating Income (1.516) (1.625) (9.490) (3.585) Interest Expense (0.004) (0.004) (0.004) (0.049) Interest and Invest. Income 0.010 0.010 0.011 0.010 Net Interest Exp. 0.006 0.006 0.007 (0.039) Currency Exchange Gains (Loss) (0.015) 0.121 (0.053) (0.007) Other Non-Operating Inc. (Exp.) - - 0.179 0.107 EBT Excl. Unusual Items (1.526) (1.498) (9.357) (3.524) Net Income (1.526) (1.498) (9.357) (3.524)

The company’s flagship “eco-friendly” local ride sharing service in Ontario has failed miserably. Not only has its ride sharing app been unable to generate meaningful revenues, it has not even been competitive – see these Facebook user reviews of Facedrive. Facedrive has a Facebook rating of only 3.5 versus 4.4 for Uber (UBER).

Facedrive's green initiative was to offer an EV (electric vehicle) option and to plant a tree as a carbon offset to their gas vehicles. But major competitors have electric vehicle options too. Moreover, there has been no mention of any offset program contributions since the August 2019 RTO into a public company, with the only donation on record being a 2019 Q1 of a mere $1,657 (CAD 2,105) to Forests Ontario.

The ride sharing service’s quarterly revenues dropped 76% sequentially to only $74k (CAD 94k) in 2020 Q2 when the COVID crisis hit. Subsequently, management pivoted into a wider campaign of diverse initiatives via small equity-swapping acquisitions.

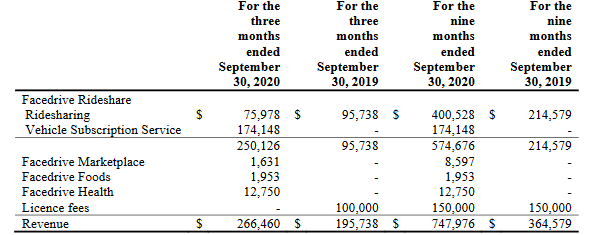

These new “activities” beyond ride sharing were mainly food delivery, health (COVID tracing app), marketplace, and then a few months later – an EV subscription service. The actual revenues of these highly-touted activities had been abysmal (see below), with COVID tracing contributing 2020 Q3 revenues of just $13k and food delivery $2k.

Two of the initiatives tried to tie the company to actor Will Smith via Bel-Air clothing and Seattle Seahawks’ quarterback Russell Wilson via the Tally acquisition, but again, not much there besides the hype. In fact, both of those activities are no longer on Facedrive's website.

Source: SEDAR filing

On October 1, 2020, Facedrive acquired Food Hwy (ethnic food delivery) for $7.2M (CAD 9.1M) consisting of CAD 1.5M in cash and CAD 7.6M in shares (515,370 shares x CAD $14.75 price per share). This low-margin business is expected to provide annual revenues of about $7.9M (CAD 10M). This is the only potential synergistic acquisition with Facedrive’s initial ride sharing business. Going forward, management hopefully will provide apples-to-apples revenue comparisons by including pro-forma 2020 and 2019 revenues of Food Hwy and other smaller acquisitions, when comparing them to reported revenues.

Aggressive Promotion + Controlled Float = High Valuation

No matter how you window dress it, this loss-making array of dysfunctional activities is close to worthless in my opinion. So, how can this company be worth $3.8B? The answer is very aggressive promotion, combined with a controlled share float.

The aggressive investor marketing is more than just the Medtronic BVI company arrangement. The company had eight press releases in just the last four weeks. These press releases had little substance. Some were repetitive of previous releases. The most meaningful of these recent press releases was probably the recent $16.1M (CAD 20.5M) fundraising at $10.63 (CAD 13.50) per share with a four-month lockup on January 18th.

The company’s press releases are filled with buzz-words like “people and planet first”, “socially responsible services”, “EV technology”, “sustainable future”, etc. This Facedrive-paid article by Oilprice.com from April 2020 - 6 Visionaries Shaping The Future Of Transportation | OilPrice.com - even compared Facedrive’s CEO to Elon Musk, Jeff Bezos and Richard Branson. In sum, these many vaporware news releases, sponsored reports and YouTube videos were more hype than substance, and twisted the narrative away from the company’s feeble and diminutive business.

Concerning the float, Facedrive initially listed on the Toronto Venture exchange with 9M shares in 2019, and then had a 10-for-1 stock split. But about 85% of those 90M shares were locked up, leaving a free float of only 13.5M at that time. Since then, 1.6M additional shares have come on the market via PIPEs, leaving a free float of 15.1M, or only 16% of the 96.8M shares outstanding. Please see the last half of this article for my view of how insiders at companies with small floats like Facedrive influence stock prices.

Time may be running out on controlling the float. The large 2019 lockup starts to expire in March 2021 in 15% increments every three months until the final 10% in September 2022. In addition, the January PIPE of 1.5M shares unlocks around the end of May 2021. Also, the shares used to acquire companies last year will eventually become free-trading as well. So, the float will soon increase. And these are low-cost shares: 22.5M (23% of total shares) at a cost of CAD 0.02 per share, 27.3M (28%) at CAD 0.08 – CAD 0.39, and 4.4M (5%) at CAD 1.58.

In total, the CEO, the two co-founders, and CFO own 68% of the total shares at a very low cost. It will be interesting to see if they and other insiders will be selling after the lockup, especially if Facedrive stock is anywhere close to the current price.

Questionable Management

The irony is Facedrive’s current CEO, Sayan Navaratnam was a director of the Petroalgae stock that I wrote about in the above article ten years ago, as well as this article - Petroalgae: $1.8 Billion Market Cap With No Revenues (OTCMKTS:PABL). Even more telling, Mr. Navaratnam was a senior managing director of Laurus Capital Management and Valens Investment Advisers, along with their founders Eugene and David Grin (see this Forbes article to learn of the questionable operations of Laurus and Valens). As you can read in the above-linked articles, Valens managed to box-in the price of Petroalgae to a value in excess of $1B for a few years on a tightly-controlled float, before the stock eventually changed names to Parabel and caved in. During that time, Valens charged its investors excessive management fees off of Petroalgae’s bloated market valuation. Petroalgae, similar to Facedrive, was an extremely overvalued company that never turned algae into biofuel as claimed to investors.

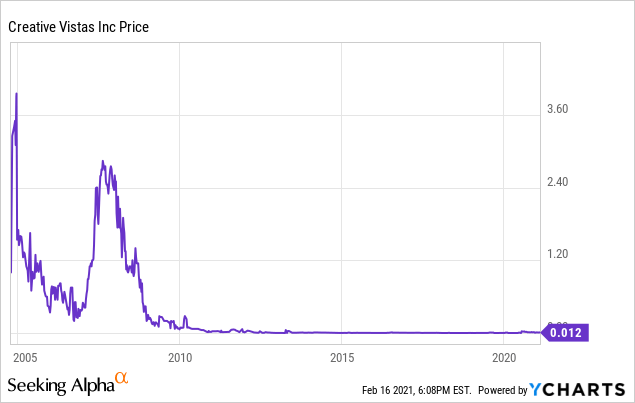

Another Valens portfolio company in which Mr. Navaratnam was CEO (and is still Chairman) was a broadband communications company called Creative Vistas (OTC:CVAS). To Mr. Navaratnam’s credit, Creative Vistas achieved peak revenues of $48M in 2008, albeit at a loss of $19M. The company revenues dropped below $10M by 2010, ceased filing in 2012, and trades as a zombie stock at $0.01 down from its peak of around $3 in August 2007.

Data by

Data byAlso, Mr. Navaratnam owns companies that have received, and are still owed money, by Facedrive – see Note 24 – Related Party Disclosures - in the latest SEDAR filing. Mr. Navaratnam’s main skill set according to his past bios is “management restructuring consulting” (i.e., turnarounds and financial engineering). As discussed, he has a questionable track record.

Ms. Heung Hung Lee has worked as a CFO for Mr. Navaratnam in his associated private companies since 2004, before becoming CFO of Facedrive. Jay Wilgar was appointed Chief Strategy Officer in March 2020. His prior post was as CEO of a cannabis company. Previously, he was also CEO of pharmaceutical and a renewable energy company.

Junaid Razvi is a Co-Founder and Executive VP. Prior to founding Facedrive, Mr. Razvi was the CEO of an IT company based in Abu Dhabi. The other Co-Founder, Imran Khan, is not currently listed as part of the management team or board of directors.

Generally, the management team is thin, with limited experience in running an internet, social media or ride sharing company. It appears that the CEO calls the shots, and heads the investor campaigns.

Finding Locates, Downside Catalysts, & A Bullish Pathway

For investors that are considering shorting Facedrive, it is not easy to find a locate. The only time that I was able to do so was just before a stock promotion, including the last one in January 2021 and in the summer of 2020. The silver lining is that the short interest is fairly low.

Bearish Facedrive reports by Hindenburg Research, Jean des Esseintes, and Mat Litalien that were written last year provide greater context. The additional catalysts that exist now are 1) the share price has roughly tripled, 2) the end of the large share lockup is closer, 3) the level of delusional euphoria in the stock market is higher today, and 4) the even higher sheer overvaluation of the stock with weak fundamentals.

Usually, I try to present the bullish side of the story when I write a bearish article. In this case, I cannot find one in the company’s current state. But there is a pathway to at least trying to grow into the company’s rich valuation. Given the high currency value of Facedrive’s shares, management can start making synergistic acquisitions that have an impact. Management should stop making cheap “show” acquisitions which have no synergies and bring little value to the company.

The last purchase of Food Hwy was a step in the right direction. Maybe more acquisitions that fit along the ethnic line, which may be more genuine, differentiable and sticky than this current ESG theme that is not getting any traction. This ESG theme is a gimmick in this case. Investors will figure this out sooner rather than later.

This article was written by

Edward Schneider, CFA

2.03K

Follower

s

Edward Schneider is a managing director of Quan Management LLC. Mr. Schneider has over 30 years of investment experience, including 25 years managing technology funds in both quoted equities and venture capital. Mr. Schneider holds a CFA designation, an MBA from Thunderbird and a BA from Emory University. Quan has generated 17% annual return since 1995, versus 11% for the Nasdaq.

Analyst’s Disclosure: I am/we are short FDVRF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

FAQs

What is Facedrive price prediction? ›

Facedrive Inc quote is equal to 0.300 USD at 2023-07-19. Based on our forecasts, a long-term increase is expected, the "FDVRF" stock price prognosis for 2027-12-10 is 32.729 USD. With a 5-year investment, the revenue is expected to be around +10809.6%. Your current $100 investment may be up to $10909.6 in 2028.

Why is Facedrive stock down? ›Facedrive stock is now down 97% from its all-time high and could head lower in the months ahead. That's because the company's former manager and co-founder said the team was exploring bankruptcy. Revenue growth has been disappointing.

What will meta price target be in 2025? ›| Year | Prediction | Change |

|---|---|---|

| 2024 | $ 402.16 | 23.70% |

| 2025 | $ 497.46 | 53.01% |

| 2026 | $ 615.34 | 89.27% |

| 2027 | $ 761.15 | 134.12% |

Stock Price Forecast

The 6 analysts offering 12-month price forecasts for Solo Brands Inc have a median target of 10.00, with a high estimate of 12.00 and a low estimate of 9.00. The median estimate represents a +72.71% increase from the last price of 5.79.